Promissory note amortization schedule

Keep your personal copy of your deed promissory note and Closing Disclosure for as long as you have your loan. On Schedule C Section 5 Borrowing Maturity Distribution page 18 report under Promissory and Other Notes Item 2 in the appropriate maturity range for the note.

Notes Payable Principlesofaccounting Com

The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

. A simple promissory note in California will have the following key elements. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. Much of it is useful for tax accounting and maintenance purposes so hang onto it.

In this video you will learn how to create drop down lists in cells in Excel. Store a copy of each of your mortgage statements for a few years to make sure all of your payments are accurate and accounted for. Select the state where the loan is taking place.

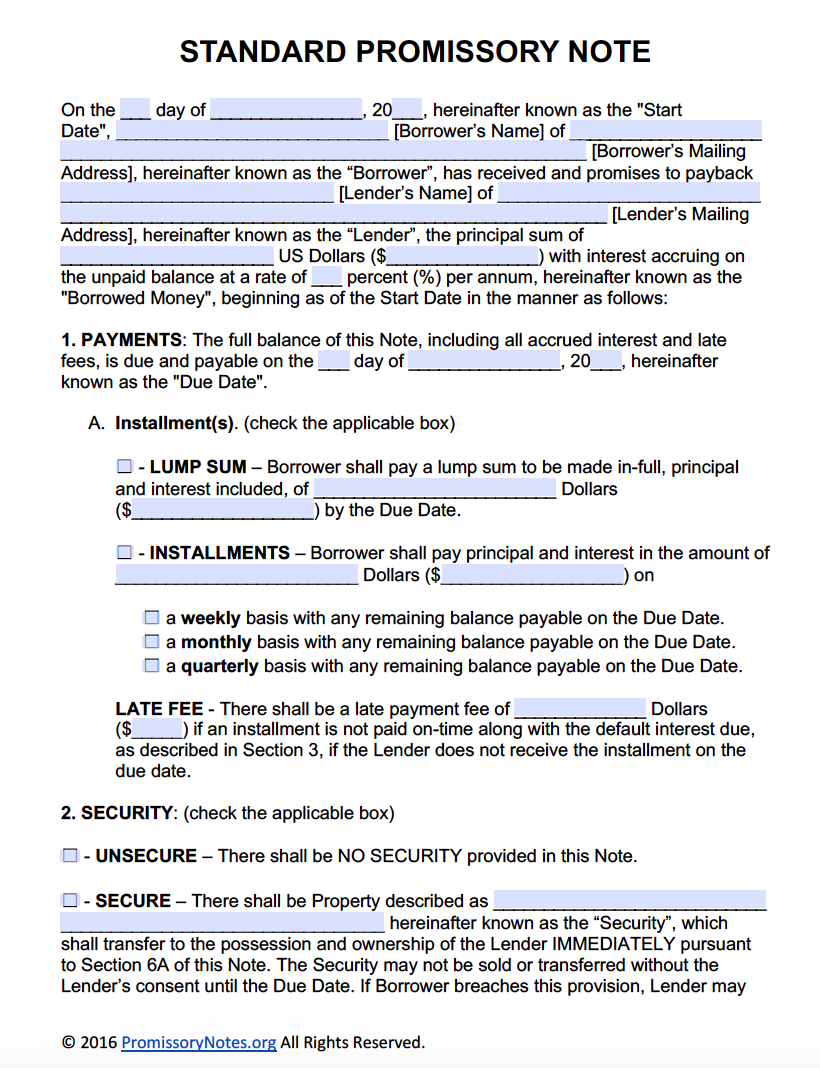

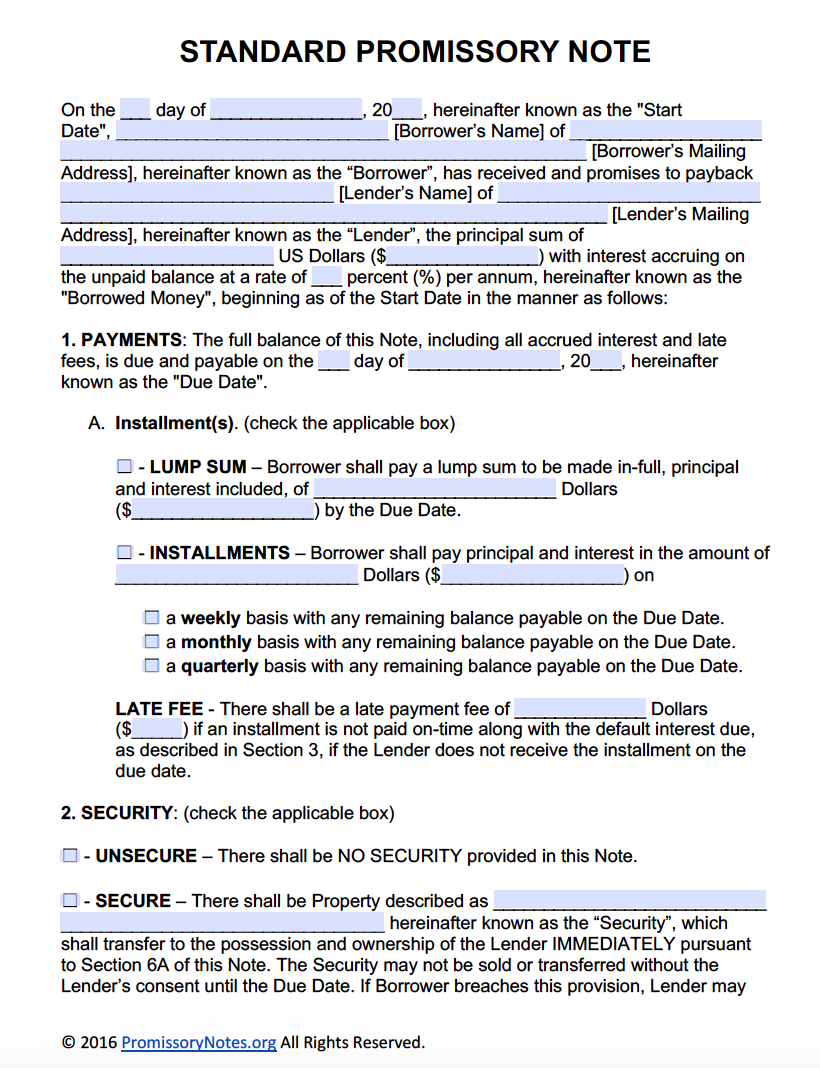

Use a Promissory Note to detail the terms of loan repayment. A mortgage also known as mortgage loan or home loan is a loan intended to purchase a property usually a house. The full outstanding balance on the note or bond should be considered Federal awards expended included in determining Type A programs and reported as loans on the Schedule of Expenditures of Federal Awards in accordance with 2 CFR part 200 subpart F.

The Amount of the Promissory Note. We welcome your comments about this publication and your suggestions for future editions. In a mortgage note templates examples the borrower is allowed to lend a certain amount of money from a lending company eg.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Mortgage loan basics Basic concepts and legal regulation. An example is lending your sibling 2000.

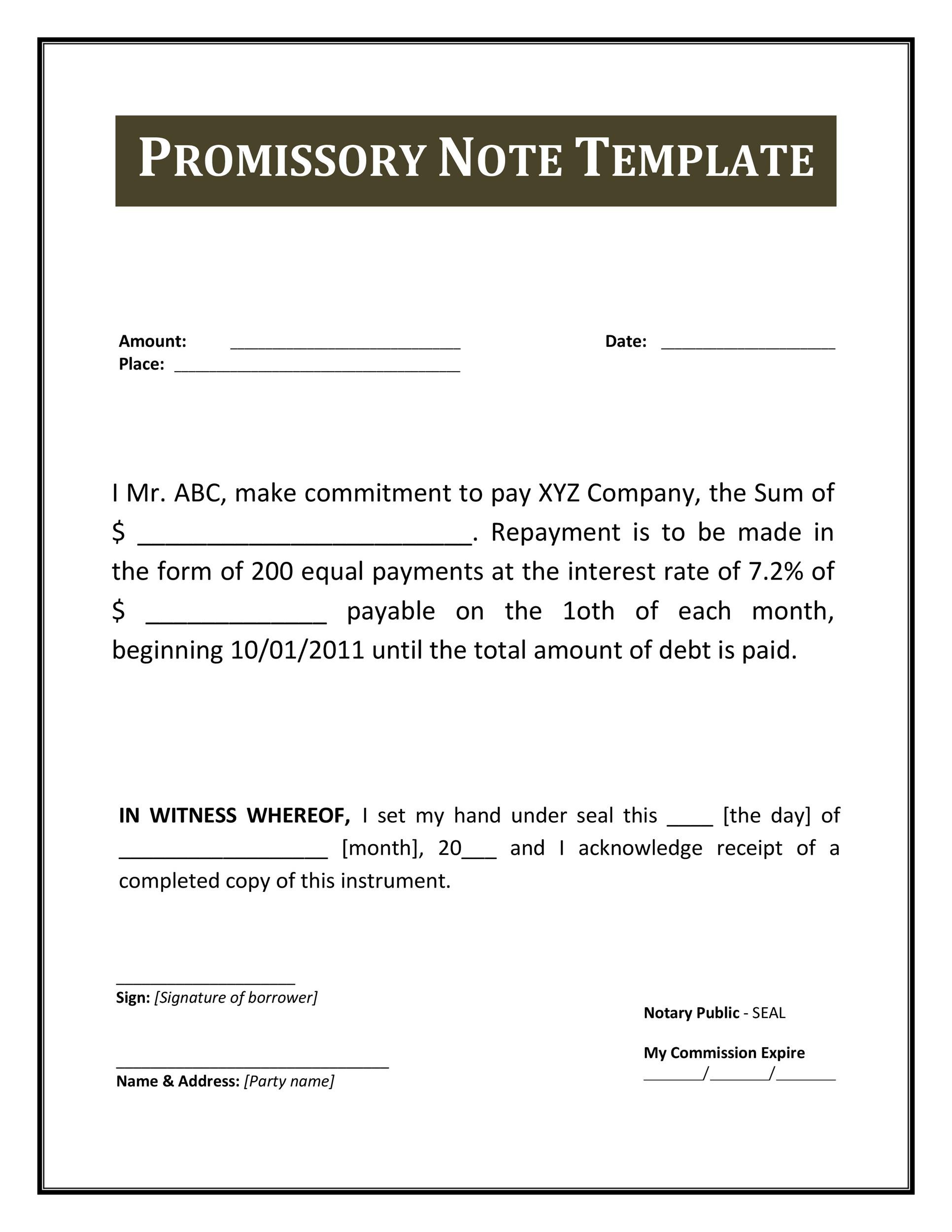

A simple promissory note will state the full amount is due on the stated date. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Another might reference the document as a demand loan or a term loan.

This is the amount or face value of the money which is borrowed by the Payer. These are also referred to as Data Validation Lists. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Learn how to easily convert an Adobe PDF file to a Microsoft Word fileI use Microsoft Word that comes with Office 365 to do the conversion. This includes a promissory note signed by both parties at the origination of the loan repayment at a similar rate of interest to what youd pay to a bank or traditional lender and keeping. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Lenders name and address. One person might call the loan contract a promissory note or a promise to pay. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period.

Close and return to top. If the loan terms are in the title of the loan the document template title is a secured loan or an unsecured note. Our Promissory Note template will customize your document specifically for the laws of your location.

The drop down lists allo. This is the date on which the Payee promises to repay the amount of the loan to the Payer. The 366 days in year option applies to leap years otherwise.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. To transfer to another person any asset such as real property or a valuable right such as a contract or promissory note. In the United States a mortgage note also known as a real estate lien note borrowers note is a promissory note secured by a specified mortgage loan.

Describe the relationship between the lender and the borrower eg friend or family member. A mortgage in itself is not a debt it is the lenders security for a debt. On Schedule C Section 4 Borrowing Arrangements page 18 report advances under Outstanding Term and Other Borrowings Account LQ0042.

You wont need a payment schedule. The person assignee who receives a. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Bank and the property heshe purchases with the money serves as a collateral. A promissory note is a legal agreement between a lender and a borrower and will contain different clauses reflecting the content of the agreement. Be repaid by December 1.

Second mortgage types Lump sum. Prior to this year the compliance supplements included language that CF loans did not. A promissory note to be paid in installments with a final balloon payment made at the end of the agreed repayment schedule.

Download a free template here Step-by-step builder PDF Word format. To calculate your repayments please read Loan Amortization Schedule article. Second mortgages come in two main forms home equity loans and home equity lines of credit.

While the mortgage deed or contract itself hypothecates or imposes a lien on the title. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. A periodic payment plan to pay a debt in which the interest and a portion of the principal are included in each payment by an established mathematical formula.

Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The Interest Rate of the Promissory Note.

The Date of Promissory Note. NW IR-6526 Washington DC 20224. Include the names and addresses of all lenders and borrowers.

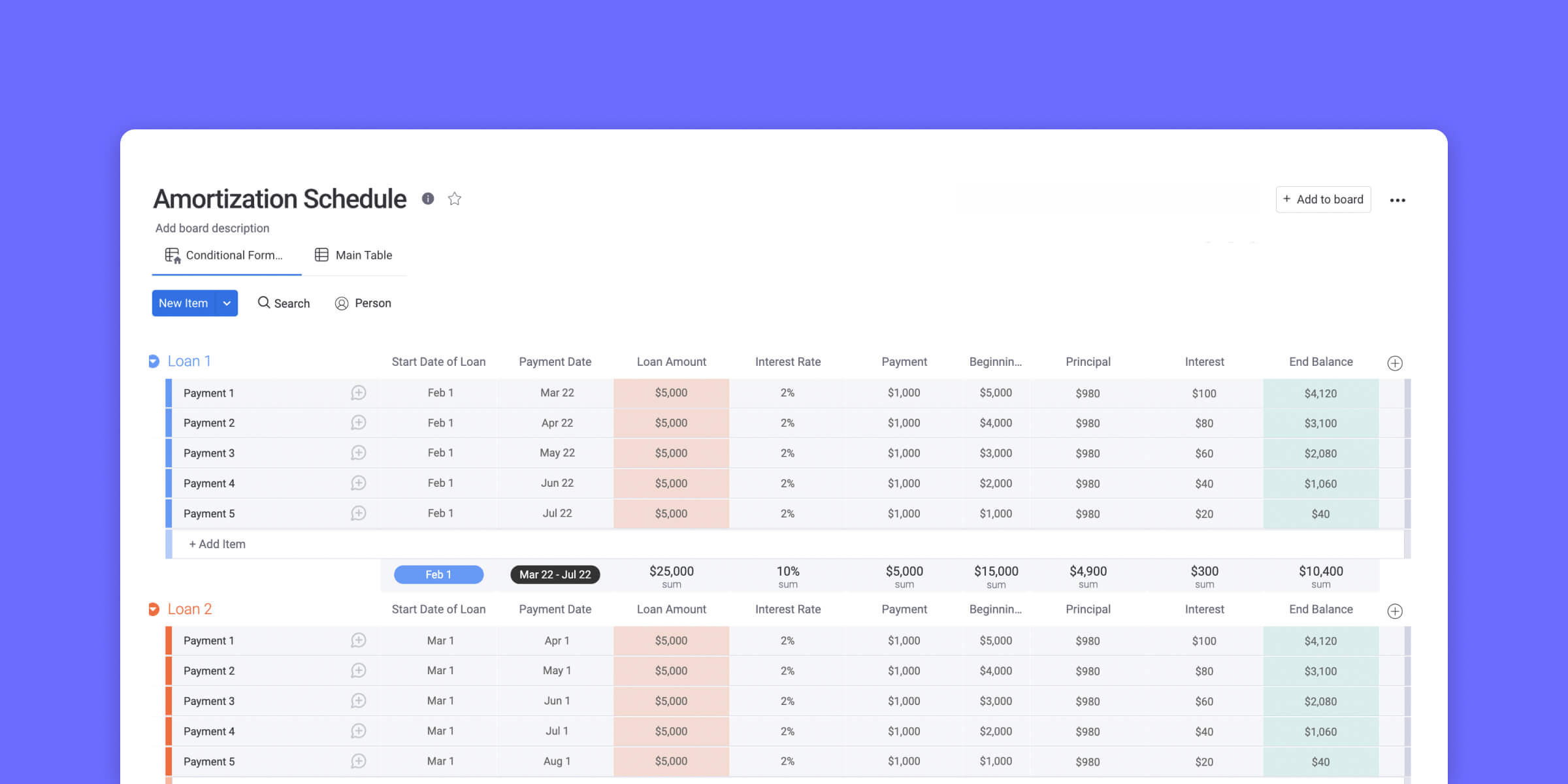

All inputs and options are explained below. There are two main categories of promissory notes. An Amortization Schedule is a loan payment calculator that helps you keep track of loan payments and accumulated interest.

Your sibling agrees to pay you money back by January 1. Amortization schedules and other details pertinent to that loan agreement. With a simple promissory note the full amount of 1000 is due on that date with no payment schedule involved.

Get 247 customer support help when you place a homework help service order with us. If youre writing a promissory note for a lump sum repayment youll typically use a simple promissory note. LawDepots Amortization Schedule lets you outline how the borrower makes loan payments such as a one-time lump sum payment at the end of the term including accumulated interest or regularly scheduled payments such as bi-weekly or.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. As Per Section 123 of the Companies Act 2013 depreciation shall be calculated as per Schedule II and these have been bought into force from 1st April 2014. So in a loan of 5000 the borrower could make monthly payments of 500 for six.

Companies act 1956 does not deal with the amortization of intangible Assets but New Schedule by companies act 2014 provides the method to amortize them. This is the amount of interest rate that is charged on the amount of loan. A Promissory note is a.

45 Free Promissory Note Templates Forms Word Pdf ᐅ Templatelab

Promissory Note What Is An Iou With Examples Adobe Sign

Simple Loan Application Form Template Elegant Loan Application Form Loan Application Application Form Job Application Form

Free Interest Only Loan Calculator For Excel

1

1

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Long Term Loan Agreement Template Cash Loans Personal Loans Business Loans

Free Promissory Note Template Adobe Pdf Microsoft Word Promissory Notes Promissory Notes

Loan Agreement Maker Apps On Google Play

1

Notes Receivable Amortization Schedule Calculated With Accounting Journal Entries Youtube

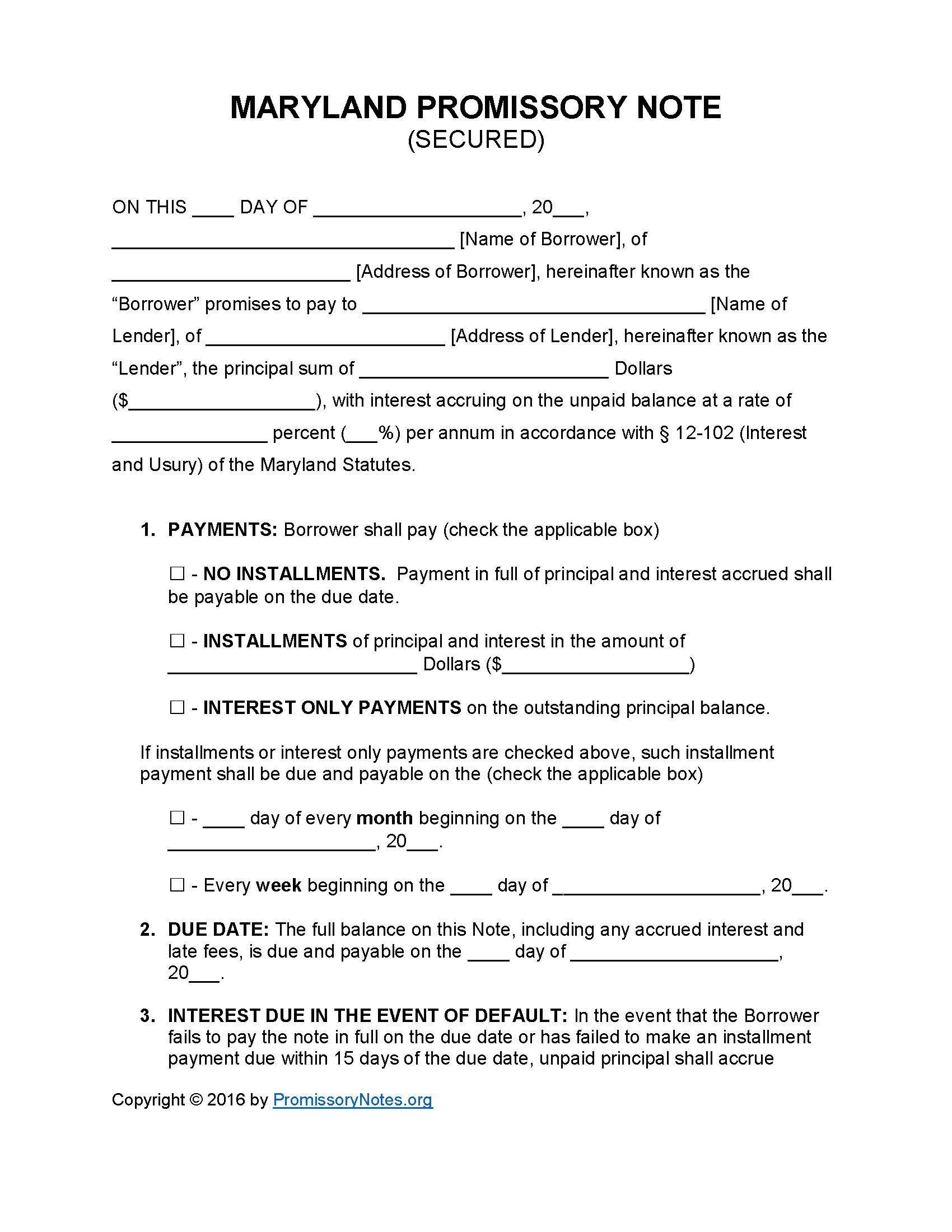

Maryland Secured Promissory Note Template Promissory Notes Promissory Notes

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

2

Amortization Schedule Notes Payable Amortization Table Creation Youtube

Amortization